Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- LTC dropped beneath its rising channel.

- LTC’s worth consolidation might persist into the weekend however change early subsequent week.

Litecoin [LTC] hit all-time low of $61 in December 2022 however rallied to $93 in January 2023, posting about 50% good points. The January rally adopted Bitcoin’s [BTC] spectacular efficiency because it jumped from $16k to $23k.

Learn Litecoin [LTC] Price Prediction 2023-24

On the time of publication, LTC’s worth was $87.23, with fundamentals suggesting an virtually impartial construction. LTC might fluctuate and consolidate inside this vary into the weekend earlier than a definitive worth motion after subsequent week’s FOMC (Federal Open Market Committee) announcement.

LTC’s worth consolidation might prolong briefly within the $82 – $93 vary

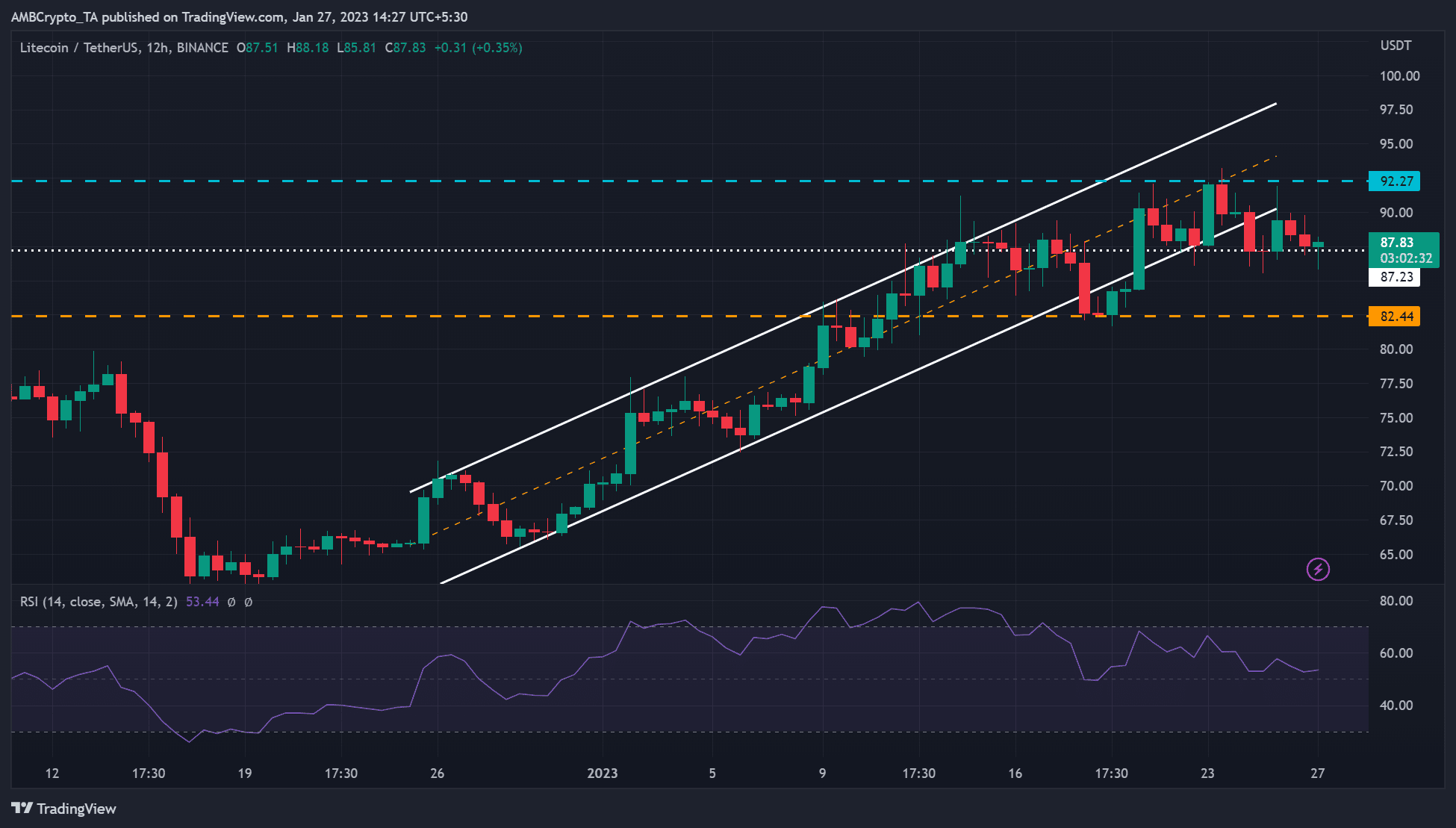

LTC’s uptrend since late December 2022 chalked a rising channel (white). However the bullish momentum confronted two key challenges. The primary problem occurred round mid-January after an prolonged worth consolidation quickly pushed LTC out of the rising channel. The $82.44 assist stage held the drop and helped LTC get better and retest the channel’s mid-line across the $90 stage.

The second problem adopted after LTC confronted worth rejection at $92.27, resulting in a correction that noticed the asset drop beneath the rising channel. LTC has been fluctuating between $87.23 and $92.27 for the previous seven days. The above worth consolidation might persist into the weekend and alter early subsequent week, relying on how BTC reacts to the FOMC launch.

A possible bullish BTC might see LTC break above the $92.27 stage and transfer again into the rising channel. Such a transfer might push LTC into the $100 zone.

However a bearish BTC would see LTC drop beneath $87.23 and retest the $82.44 assist, invalidating the forecast described above.

LTC’s RSI worth was 53 on the 12-hour chart, with potential rejection and rebound from the mid-level of fifty based mostly on historic patterns. Due to this fact, LTC’s consolidation might proceed into the weekend.

LTC’s open curiosity fluctuated as holders’ income declined

Is your portfolio inexperienced? Try the LTC Profit Calculator

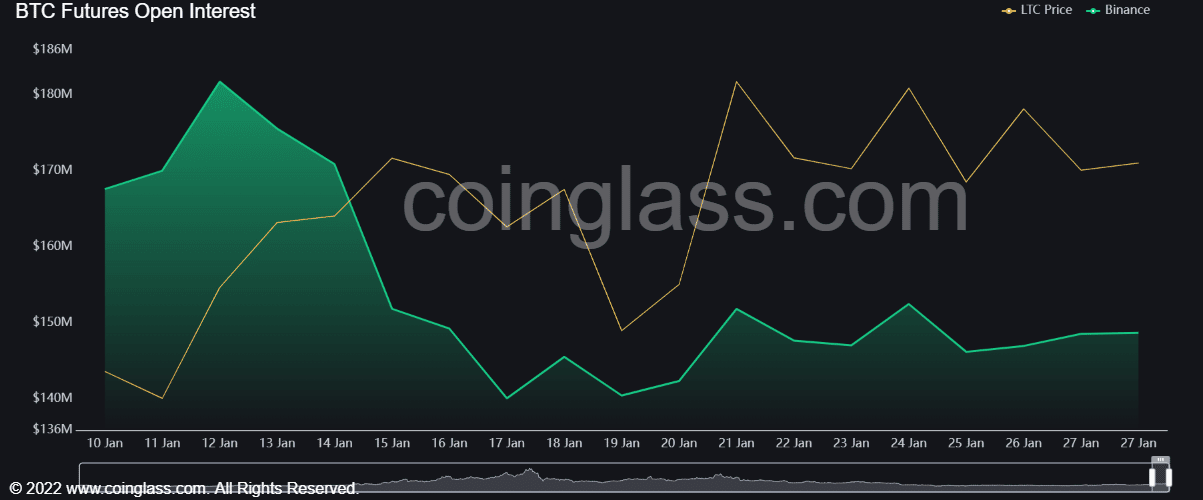

As per Coinglass’ knowledge, LTC’s open curiosity (OI) charges declined round mid-January earlier than fluctuating afterward. Nevertheless, at press time, LTC recorded a delicate rise in OI, displaying that extra money was shifting into its futures market – a pattern that might enhance its uptrend momentum.

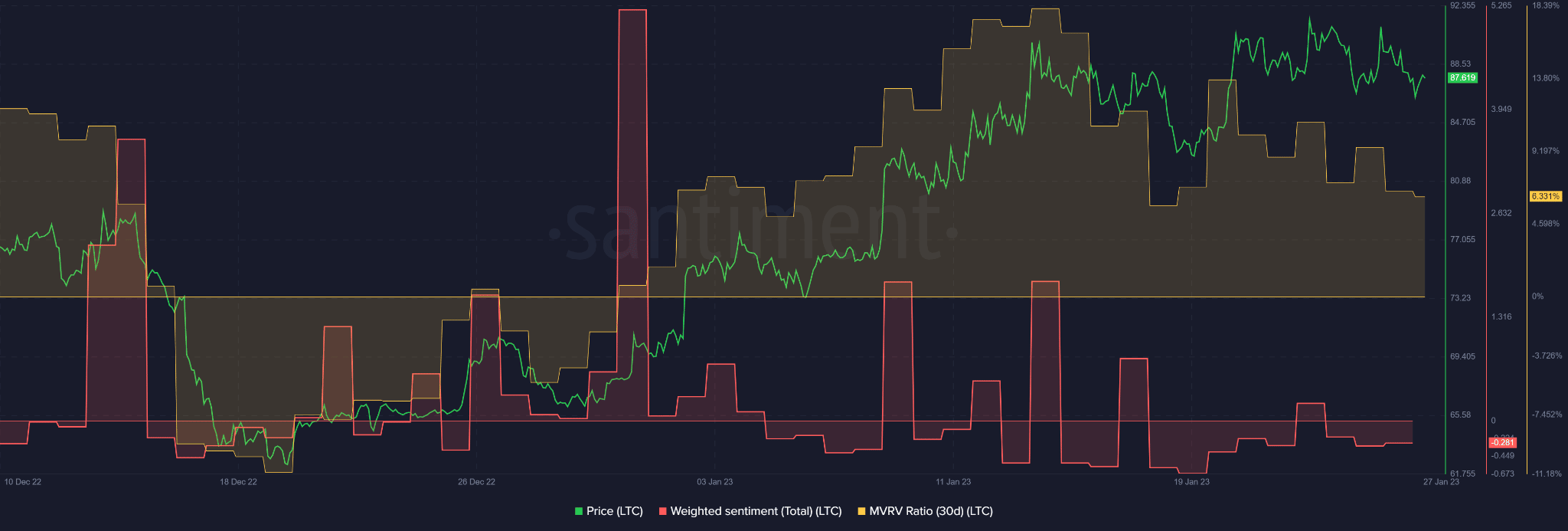

However, worth fluctuations reduce down holders’ income. Based on Santiment, the 30-day MVRV declined from 20% to six%; thus, short-term holders’ income dropped by over 10%. The drop additionally noticed buyers undertake a considerably bearish outlook, as evidenced by the adverse sentiment.

![Litecoin [LTC] momentum weakens – but is a reversal likely](https://www.diffrintcrypto.com/wp-content/uploads/2023/01/michael-fortsch-fYSVVQqiqPs-unsplash-1000x600-750x375.jpg)