[ad_1]

Crypto markets noticed minimal volatility over the previous 24 hours regardless of Digital Forex Group (DCG) subsidiary firm Genesis World Capital filing for Chapter 11 bankruptcy on Jan. 19.

Insolvency rumors had been circulating as early as November 2022, when Gemini alternate paused withdrawals from its Earn program attributable to Genesis, its lending associate, pausing withdrawals.

The following public spat between Gemini co-founder Tyler Winklevoss and DCG CEO Barry Silbert highlighted the liquidity points at DCG and Genesis, together with doubtful intercompany transfers. In the meantime, Cameron Winklevoss mentioned:

“So how does DCG owe Genesis $1.675 billion if it didn’t borrow the cash? Oh proper, that promissory notice…“

The general public backlash was mounting, with the FTX-Alameda state of affairs contemporary in everybody’s thoughts.

In line with the chapter submitting, the highest 50 Genesis collectors are owed a complete of $3.5 billion, with essentially the most important debt owed to Gemini at $769 million. Different notable collectors embrace Van Eck, Abra, and Decentraland.

Crypto markets maintain regular

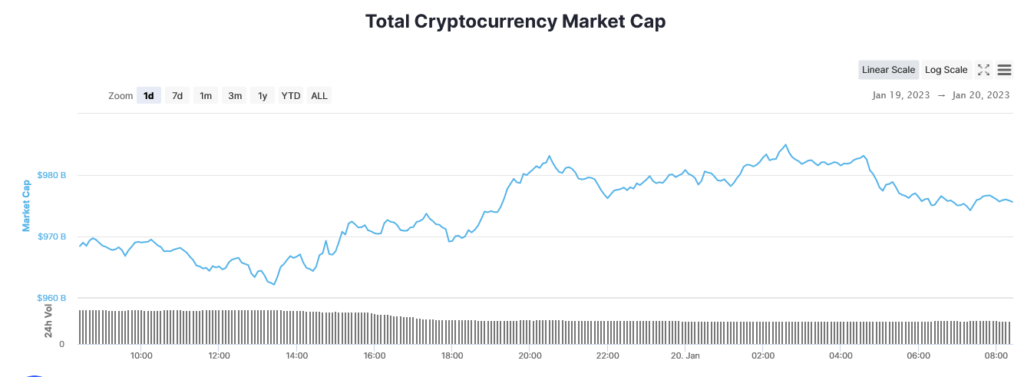

Regardless of the blow, crypto markets had been seemingly unfazed by the occasions. During the last 24 hours, the whole market cap dipped to as little as $962.17 billion on Jan. 19.

Nevertheless, there have been no sharp sell-offs in response to the information. As a substitute, after bottoming, the whole market cap noticed inflows that peaked at $984.96 billion within the early hours of the next day.

Market chief Bitcoin grew 0.74% in worth over the interval. On the identical time, the remainder of the massive caps recorded related, flat performances.

Genesis chapter was priced in

Co-founder of crypto VC agency Placeholder Chris Burniske acknowledged a tweet from @Flowslikeosmo, stating the market had priced within the Genesis chapter.

“Necessary to acknowledge when market begins shrugging off dangerous information.”

Equally, Investor Mike Alfred echoed these feedback whereas alluding to the months of prior discover. Nevertheless, referencing the big-name collectors and their collectors, Alfred warned of additional bother down the road.

“The Genesis chapter was priced in. Everybody knew it was coming. Not that attention-grabbing. What’s attention-grabbing is pondering by way of the potential 2nd and third order knock on results that the market doesn’t absolutely respect but.“

[ad_2]

Source link